surveys & research

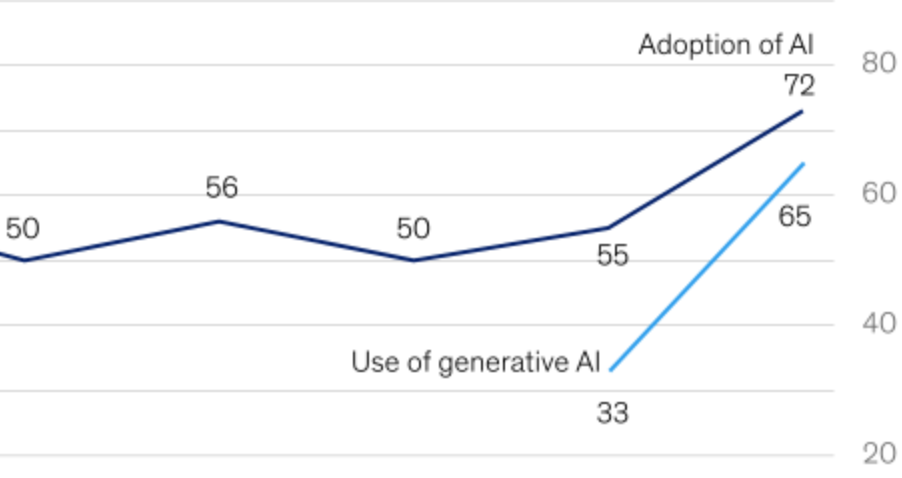

gen ai in accounting: epic transformation, or overheated hype?

main street accountants see turbulence ahead for small business

partners: your middle managers are getting squeezed

1 in 4 accounting professionals want more dei

cas can play a critical role in clients’ vendor selection

the needed skills are already part of the accountant’s skill set; they just need to be applied outside of the finance function.

by donny c. shimamoto, cpa, citp, cgma

center for accounting transformation

jobs outlook: strong and steady growth in hiring and earnings for u.s. accountants

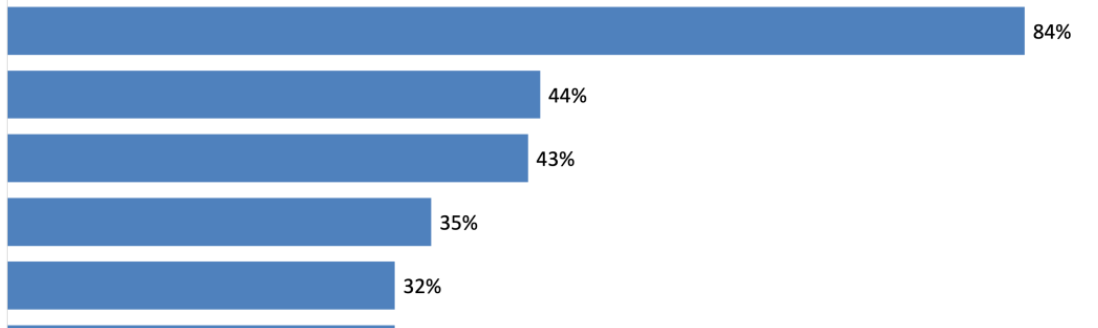

explaining the talent shortage in one big chart | cornerstone

understanding the inflection points

in number of cpa exam candidates

卡塔尔世界杯常规比赛时间 cornerstone report

turnover timebomb: 4 of 5 senior managers at risk

and seven ways to overcome staffing issues.

by hitendra patil

battling the staffing crisis: is a little-known, but controversial, visa program the answer?

staffing tops list of woes at cpa firms

salary and compensation outlook for small cpa firms, 2024-2025

cornerstone report: 卡塔尔世界杯常规比赛时间 projects significant increases in 2025 compensation for professionals and matching expansions of payroll costs at small cpa firms. but partners and owners could get even bigger earnings gains.